When Does Shopify Send 1099: A Comprehensive Guide for Merchants

Shopify is an eCommerce platform that provides individuals and businesses with a way to create and manage their online stores. If you’re using Shopify merchants to sell products and services, you may receive a 1099-K form from Shopify.

A 1099-K tax form reports the total payment transactions processed through your Shopify account. But when does Shopify send 1099 forms to merchants? The answer is if your Shopify payments gateway and total sales meet a certain threshold.

In this article, we will explore the details of Shopify’s 1099 form tax requirements and when Shopify sends 1099.

Understanding the 1099 Tax Form

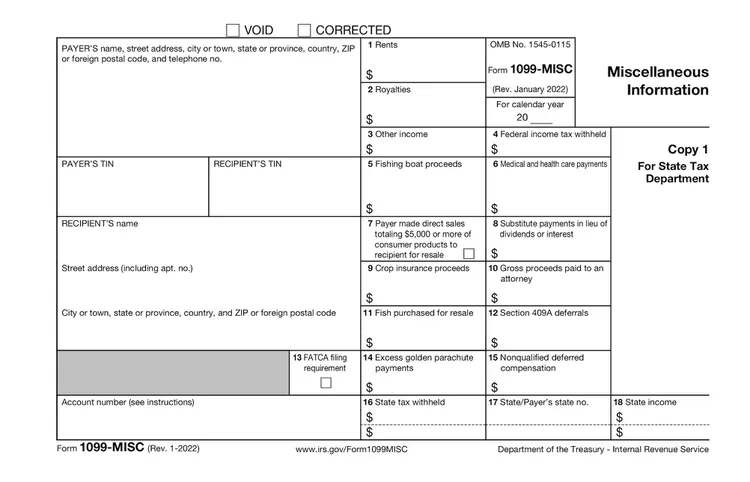

What is a 1099 tax form?

The 1099 tax form is a series of documents that report various types of income other than salaries, wages, and tips. It serves as a record of income received by an individual or a business that is not an employer.

The role it plays in reporting income to the IRS

The primary role of the 1099 form is to report income earned from various sources, such as freelance work, self-employment, rental income, or investment gains. This information is crucial for taxpayers and the Internal Revenue Service (IRS) to ensure accurate income reporting.

Types of 1099 forms and which one is relevant for Shopify merchants

Various types of 1099 tax forms, also known as “information returns,” each serving a specific purpose. Here’s an overview of common Form 1099s and their significance:

- 1099-A: Issued if a short sale or the cancellation of all or a portion of your mortgage by your mortgage lender occurred.

- 1099-B: This form reports income from the sale of securities and bartering.

- 1099-C: Indicates canceled debt and potential taxable income from settling a debt for less than owed.

- 1099-CAP: Received if you hold shares of a corporation undergoing a significant change, providing cash, stock, or other property.

- 1099-DIV: Reports dividends received, excluding dividends on share accounts at credit unions.

- 1099-G: It is issued for government payments, including tax refunds, credits, or offsets, and for unemployed individuals.

- 1099-INT: Provided for earning $10 or more in interest from a financial institution.

- 1099-K: Sent for business income or payments exceeding $20,000 via credit card or third-party payment systems, with more than 200 transactions per year.

- 1099-LTC: Furnished if your long-term care insurance paid benefits or if you received accelerated death benefits from a life insurance policy.

- 1099-MISC: A catch-all for miscellaneous income that doesn’t fit into specific categories, such as income from prizes and awards.

- 1099-NEC: It was introduced in 2020 to report payments made to non-employees, freelancers, or those with side gigs.

- 1099-OID: Received if you bought financial instruments at a discount to face value or redemption value at maturity.

- 1099-PATR: Sent to co-op members who received at least $10 in patronage dividends.

- 1099-Q: Reports money received from a 529 plan for education expenses.

- 1099-R: It is Issued for pension plans, retirement accounts, or annuities distributions.

- 1099-S: Furnished for real estate sales or exchanges, reporting the proceeds.

- 1099-SA: It is received for distributions from health savings accounts, Archer medical savings accounts, or Medicare Advantage.

Relevant for Shopify merchants

For Shopify merchants, the most relevant form is likely to be the Form 1099-K, which reports Payment Card and Third Party Network Transactions. This form is used to report payment transactions made through card payment entities or third-party settlement organizations.

If you are a Shopify merchant and use a third-party network such as Shopify Payments to process your transactions, you’ll need to meet certain criteria. Once these conditions are met, you can anticipate receiving a 1099-K form.

Recommended Blogs for you:

👉 What is SKU in Shopify?

👉 How to Add Social Share Buttons on Shopify Store: A Comprehensive Guideline

👉 What is Compare Price on Shopify?

👉 How to Change Domain Name on Shopify: The Ultimate Guide

👉 How to Export Images from Shopify: A Step-By-Step Guide

Criteria for Receiving a 1099 from Shopify

To receive a 1099 from Shopify, merchants must meet specific financial thresholds. Here’s a breakdown of the key criteria of when Shopify sends 1099 :

Explanation of the financial thresholds that trigger the issuance of a 1099

Shopify merchants receive a 1099 form from Shopify when they meet specific financial thresholds. The criteria for receiving a 1099 from Shopify include:

Gross Sales: Merchants must have earned at least $20,000 in gross sales through Shopify during the tax year.

Transaction Volume: In addition to the sales threshold, merchants must have processed at least 200 transactions through Shopify during the same tax year.

The issuance of a 1099 form, particularly a 1099-K, is prompted when certain benchmarks are reached. These benchmarks include gross sales of $20,000 and 200 or more transactions. This 1099-K form is used to report the income that was generated on the platform. Merchants must know these thresholds to ensure compliance with tax reporting tax requirements.

The distinction between gross and net sales for tax purposes

Gross sales refer to the total revenue generated before deducting expenses. In the context of a 1099-K, it includes the total amount processed through Shopify Payments, regardless of refunds, chargebacks, or other deductions. Net sales, conversely, deduct expenses, refunds, and other charges from the gross sales to calculate the actual profit.

🚀Boost Your Online Store Sales with Mavon Shopify Theme!

Mavon – Your ticket to success! 🚀 Boost revenue with conversion-focused features and intuitive design, turning visitors into loyal customers.

Timing: When Does Shopify Send 1099

Shopify typically sends out 1099 forms to eligible merchants within the following timeline:

Detailed timeline of when Shopify typically sends out 1099 forms

Shopify typically sends 1099 forms to eligible merchants each year by the end of January. This timeline aligns with the IRS deadline for distributing these forms to recipients.

Discussion on any factors that might delay this process

Factors that delay this process include any updates or changes in tax regulations, technical issues, or other unforeseen circumstances. Merchants are advised to check their Shopify payments and email notifications. If they notice any delays in the receipt of their 1099 forms, they should promptly get in touch with Shopify support. Merchants must stay informed about any announcements or updates from Shopify regarding tax reporting.

What to Do If You Don’t Receive Your 1099

If you haven’t received your 1099 form from Shopify, you can take the following steps:

Grow Your eCommerce Business with Valuable Resources, Tools, and Lead Magnets

- Bring your ideas to life for $1/month

- One platform that lets you sell wherever your customers are—online

- Create a beautiful eCommerce website

- Start for free, then enjoy $1/month for 3 months

- Build your own website in a few steps

- Create a website in minutes easily, secure method

- Turn what you love into what you sell

- Discover the Shopify Point of Sale

- AI Based Business Name Generator

How to Prepare for Tax Season as a Shopify Merchant

As a Shopify merchant, preparing for tax season involves several key steps to make sure accurate reporting and compliance:

Tips on how to keep track of sales and expenses throughout the year

- Use Shopify Reports: Leverage Shopify’s reporting tools to monitor your sales, track inventory, and gain insights into customer behavior. Regularly review reports to understand your business’s financial health.

- Implement Accounting Software: Consider integrating accounting software with your Shopify store. This can streamline financial record-keeping, making tracking expenses, profits, and other key financial metrics easier.

- Organize Receipts and Invoices: Keep all business-related receipts and invoices organized. Categorize them to facilitate easy retrieval when needed for sales tax purposes.

- Record Business Expenses Promptly: Record business expenses promptly. Waiting until sales tax season to gather this information can lead to errors and oversights. Regularly update your records throughout the year.

The importance of consulting with a tax professional

Consulting with a tax professional holds significant significance for Shopify merchants for several key reasons:

- Expert Guidance: Engage with a qualified sales tax professional or accountant who specializes in eCommerce. Their expertise can provide valuable insights into applicable deductions, tax credits, and compliance with tax laws.

- Ensure Compliance: Sales tax laws are complex and subject to change. A tax professional stays updated on these changes and ensures your business remains in compliance. This helps avoid penalties and legal issues.

- Strategic Tax Planning: Work with a sales tax professional to develop a strategic tax plan. This involves optimizing your business structure, timing of purchases, and other strategies to minimize tax liabilities.

- Efficient Tax Filing: Professional assistance ensures accurate and efficient tax filing service. Tax filing services reduce the risk of errors and may expedite the process, giving you peace of mind during sales tax season.

Frequently Asked Questions

When does Shopify send 1099 forms?

Shopify typically sends 1099 forms by January 31st of each year. Merchants can access these forms electronically through their Shopify accounts.

What financial thresholds trigger the issuance of a 1099?

Merchants who have earned $20,000 or more in gross sales and have processed 200 or more transactions through Shopify will receive a 1099-K.

What should I do if I don’t receive my 1099 form?

Contact Shopify Support if you haven’t received your 1099 form by early February. They can provide guidance and help resolve any issues.

Can I access my 1099 form online?

Yes, you can access your 1099 form electronically through your Shopify account. Log in and navigate to the Tax Documents section.

How do I report income from Shopify on my tax return?

Use the information on your 1099 form to accurately report your Shopify income on your sales tax return. Include the gross sales and transactions as reported on the form.

Hire Experts to Build Your Shopify Store: Recommended- ShopiBuffet

ShopiBuffet offers a tailored solution for entrepreneurs venturing into online stores. Their seasoned professionals assist in setting up a fully functional online store by providing services such as theme installation, navigation configuration, and organizing products into collections.

Moreover, they prioritize customer support, ensuring prompt assistance through Q&A sessions. Regardless of your experience level, ShopiBuffet provides an optimal platform to streamline your business operations. Explore their services for seamless theme installation, demo setup, product and collection arrangement, and navigation customization.

What Services Shopibuffet Offer:

- Theme Installation & Demo Setup

- Product & Collection Setup

- Navigation Setup

- Shopify SEO Services

- Shopify migration service

Conclusion

As a seller on Shopify, tax reporting can be a bit complicated. Well, the answer is not a simple one. Shopify does not actually send 1099 forms. However, Shopify will report your earnings to the IRS if you make over $20,000 in sales and have over 200 transactions on the platform.

This means you’ll need to keep track of your income and expenses throughout the year and file an accurate tax return. Don’t let the sales tax reporting process stress you out too much. Shopify has various resources available to help you navigate the tax season and ensure you submit the necessary forms to the appropriate authorities.